-

The New Orleans home market is starting to show promise when it comes to affordability. That’s good news for homeowners looking to buy a home in the city.

This article will tell you everything you need to know about buying a home in New Orleans.

Should You Buy A Home In New Orleans?

New Orleans is one of the most popular cities in America for many reasons. Not only is the cuisine second to none, but the communities and culture that make up the city is one of the most unique in the world.

If you’re considering buying a home in New Orleans, you should know that safety concerns are something every major city grapples with, some more than others. Most of all, your decision should be one based on what you want in a city and how well you’re financially prepared to be a homeowner. This article will help you with the latter.

Table of Contents:

- Get Your Credit Right

- Save Up for a Down Payment

- Get Pre-Approved

- Find Affordable Homes

Get Your Credit Right

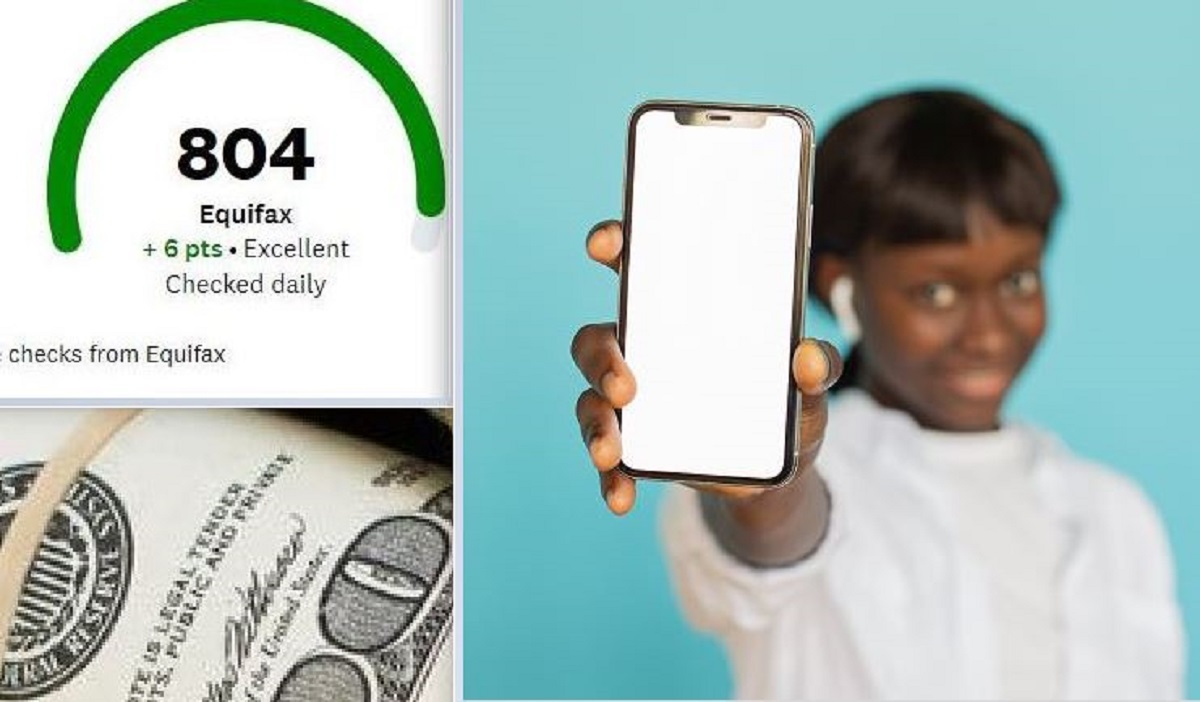

Unless you have tens of thousands of dollars just laying around the house or in a bank, your credit score is the single most important thing you need to get a home.

A high credit score will improve your chances exponentially when it comes to borrowing enough money for a 30-year mortgage.

If your credit score is not over 500, then you’re going to need to raise it before you qualify for a home.

Read how to improve your credit score.

Save Up For A Down Payment

One of the biggest obstacles to owning a home is coming up with the down payment.

No matter what you think, the typical lender wants you to have about 20% set aside for a down payment. If you want a home that costs about $250,000, you’ll need around $50,000.

Once you get the money, the lender will look favorably upon letting you borrow the cash you need for a home.

Get Pre-Approved

The first thing you need to do is get pre-approved for a mortgage.

Once you’re pre-approved, you can shop for cheap homes that fit your budget based on the location.

Find Affordable Homes

Once you’re pre-approved, it’s time to start shopping for a home. No matter if you find a licensed real estate professional or not, you should have an idea of what home values are around the city.

Here are some sites that have homes for sale:

Can You Afford A Home In New Orleans?

New Orleans received a failing grade when it comes to the number of affordable houses, according to HousingNOLA, a coalition of organizations focused on affordability in the city.

But with that said, affording a home in New Orleans is doable, but you’ll need to make sure you’re saving enough money for a down payment.

Once the down payment is taken care of, think of the expenses you’ll need to pay for including:

- Property Taxes

- HOA Fees

- Mortgage Insurance

- Homeowners Insurance

What Are The Average Homes Values Near You?

According to Zillow, New Orleans home values average about $267,805 for the latest figures. Here are home values across the United States.

Metropolitan Area* November Zillow Home Value Index (ZHVI) (Raw) November ZHVI Decline from Peak Monthly Mortgage Cost (at 20% Down) Monthly Mortgage Cost Change, Month over Month Total Inventory Change, Year over Year (YoY) Median Days on Market Change (YoY) Zillow Observed Rent Index (ZORI) United States $357,733 -0.5 % $1,809 -4.8 % 7.0 % 11 $2,008 New York, NY $619,212 -0.3 % $3,125 -4.8 % -14.5 % -6 $3,130 Los Angeles, CA $890,637 -7.2 % $4,541 -5.4 % 9.2 % 13 $2,950 Chicago, IL $309,755 -1.4 % $1,568 -4.8 % -18.9 % 5 $1,851 Dallas–Fort Worth, TX $387,308 -3.0 % $1,965 -5.0 % 4.0 % 6 $1,833 Philadelphia, PA $343,687 0.0 % $1,727 -4.3 % -10.4 % 4 $1,780 Houston, TX $314,507 -0.4 % $1,589 -4.8 % 12.2 % 16 $1,651 Washington, DC $551,159 -0.7 % $2,784 -4.7 % -11.0 % 10 $2,223 Miami–Fort Lauderdale, FL $482,142 0.0 % $2,418 -4.3 % 11.4 % 12 $2,788 Atlanta, GA $381,824 -0.8 % $1,929 -5.0 % 14.2 % 18 $1,980 Boston, MA $643,642 -2.8 % $3,264 -5.1 % -1.1 % 4 $2,827 Make An Offer

Once you find an affordable home, it’s time to get a home inspection and if everything checks out, make an offer. Once the offer, the owner will have a specified time, typically up to 30 days to reject the offer or approve it.

Some issues that could delay the acceptance of an offer are the appraisals or comparable home values in the neighborhood. Sometimes, offering prices may need to be adjusted to fall in line with what other homes in the area have recently sold for.

In other cases, there may be some fixes that need to be done, before the sale proceeds.

Once the offer is accepted, you’ve got yourself a home!

Final Word

Buying a home is one of the most expensive things you can purchase, but also one of the most rewarding. Remember to take your time and do your due diligence to make sure the home meets your standards in every way.

Looking for something to do in the city? What To See And Do In New Orleans.

More From NolaFi.com:

-

If you’re trying to buy a house, one of the most important determining factors is your creditworthiness.

This article will show you what credit score you need to have to buy a home.

What Is Considered A Good Credit Score?

A good credit score ranges between 600-730. The three-digit FICO credit score can go all the way up to 850, which is elite credit.

Most Americans fall within the lower 700s when it comes to their credit scores, but there are millions of people who are way below that. If you’re part of that group, first, you need to understand how you may be hurting your credit score. For instance, are you carrying a balance from one month to the next? That’s the #1 credit-hindering mistake many consumers make.

Pay your credit card bill in full to raise your credit score. That’s the key. Once you’re out of debt, you can begin saving for a house.

What Credit Score Do I Need To Buy A House?

To buy a house, your credit score needs to be at least 600, according to mortgage lenders. Anything below that and you’re in the sub-par category, which greatly restricts your purchasing power.

Buying a home is one of the largest purchases you’ll ever make. Typically, you’ll have to borrow enough money for a 15- year or 30-year loan. What usually determines which loan you choose is the amount of income you bring in and your credit score.

Final Word

Your credit score is an integral piece of your financial well-being. If you want to purchase a home. To stay on top of your credit score, you can get a free credit report delivered to you online.

You can buy a house with without a credit score as well: By paying all cash, which is something investors do all the time.

Are you looking into becoming a landlord? Here’s how to buy rental property in Louisiana.

More From NolaFi.com:

-

Rent prices are on a tear these days and it’s been like that for the last few years. When will rents drop again? One city in Louisiana is defying the trends in one crucial apartment segment for single people: studio apartments.

Baton Rouge is the cheapest city in America when it comes to rents for studio apartments, according to Rent.com.

Baton Rouge, which is located about 70 miles from New Orleans, has not been spared the high rents that other cities have been experiencing over the past few years when it comes to two- and three-bedroom apartments, but the new data bodes well for singles.

Cheapest Cities For Studio Apartments

Rank City Population Avg. Studio Rent Avg. 1BR Rent Avg. 2BR Rent 1 Baton Rouge, LA 220,236 $586 $1,056 $1,088 2 Fargo, ND 124,662 $626 $826 $936 3 Grand Forks, ND 55,839 $676 $800 $890 4 San Antonio, TX 1,547,253 $750 $1,078 $1,304 5 Jacksonville, FL 911,507 $753 $1,470 $1,723 6 Omaha, NE 478,192 $827 $983 $1,343 7 Chattanooga, TN 182,799 $894 $1,016 $1,939 8 Glendale, AZ 252,381 $900 $1,579 $1,908 9 Des Moines, IA 214,237 $904 $1,221 $1,393 10 Albuquerque, NM 560,513 $923 $1,165 $1,412 Final Word

When it comes to studio apartments, the average size for a Baton Rouge, apartment is 941 square feet, but it could change based on unit type.

If you’re tired of renting, it may be time for you to get a home. Here are the steps you need.

-

Airbnb has made it super-easy to rent out your home. If you’re in New Orleans homeowner thinking about making some extra cash, read on.

You may be wondering how to go about renting your home on Airbnb. This guide breaks the process down step by step.

Here’s How To Rent Your Home On Airbnb

In New Orleans, hotels can charge high rates, not to mention a pricey parking fee if you have a vehicle. For many people, it makes sense to rent a home on Airbnb instead.

All you have to do is be willing to rent your property for a few days to make some good money. But before you do, make sure that you reside in an area / neighborhood where new faces are welcome and guests feel safe.

It’s also a good idea to to make sure your neighbors are aware of what’s going on to a reasonable degree. You might also want to check to see if your homeowners association forbids it.

If you’re all clear, then you just need to prepare to rent your home.

How Old Do You Have To Be To Rent On Airbnb?

Airbnb’s terms of use indicate, guests and hosts must be 18 years or older. No children are allowed to create an account.

That means you won’t have to worry about young kids renting out your home for a Sweet 16 party. College students, however, are generally old enough to use the platform.

What Percentage Of Rent Does Airbnb Take?

iAirbnb charges a service fee of 3% for hosts with a residential listing. If you have a Super Strict cancellation policy, you may be charged more based on other factors.

Now let’s go over how to set up your Airbnb account.

List Your Home In 6 Steps

1. Set up an account and log onto Airbnb.com, click on “Add a listing.”

2. Once you go through the prompts, you’ll choose whether this is a guest house or one where you “keep your personal belongings.”

You’ll also need to disclose whether you’re listing on behalf of a company or just yourself.

3. Under “Sleeping Arrangements,” add how many beds are in the bedroom(s) as well as if you have a sofa bed.

4. Once you add your address, you’ll need to confirm on a Google Map embedded in the page. Next, list any amenities like Wi-Fi, heat, AC (yes, those are all amenities) so that guests know what to expect.

5. Next list all the “Spaces” that guests can use (pool, washing machine, dryer, etc.).

6. Upload pictures of your home then describe your place, neighborhood and surrounding features to really sell it to would-be guests.

Once you do that, you’re ready to press the button to list your home.

3 Tips & Tricks When Renting Your Home On Airbnb

- Remember, all transactions should be handled by Airbnb. Do not accept cash payment outside of the online system, that’s how trouble and discrepancies can arise.

- Always draft some house rules: Let your guests know that this is not an anything-goes residence and that big parties are a no-no.

- Before you accept a guest, make sure they have great reviews. If you read their ratings on Airbnb, that will give you the greatest indication of what type of guest they are.

Final Word

Renting your home out on Airbnb can be an easy way to make some extra cash. If you live in New Orleans, the city has so many visitors that renting a home instead of a hotel is a viable option.

As you can see, there is some money to be made from renting your home out on Airbnb. To make the most of your home, always communicate your house rules to your guests ahead of time so there’s no misunderstanding.

Also, we can’t stress it enough: Let your close neighbors know that you’re listing your home on Airbnb.

There’s nothing worse than you renting out your home only to get a call from the cops hours later, saying that your neighbor reported a suspicious person on your property.

New Orleans has one of the best real estate markets in the South, with affordable housing in large swaths of the city. Large backyards and strong, vibrant neighborhoods with ample dining amenities make it one of the top places for transplants looking for a new home.

Keep up with what’s going on in New Orleans’ real estate scene here.More Articles From NolaFi:

-

If you’re planning to buy a house, you’re going to need some money You don’t need the whole amount, but you do need a down payment.

To come up with what you need, you need to devise a plan to save money. You can save a bit if you plan to buy a foreclosure, but otherwise, it’s going to be a full-price home.

In this article, we will tell you some ways that you can save for a home.

Here Are 5 Ways To Save Up For A House This Year

Homeownership is an achievement that comes with the American Dream. The problem is that relatively few people ever realize it. But you certainly can. Here are the steps:

1. Set A Realistic Goal

The first thing you need to do is set a realistic goal for the type of home you want to afford. If you think a $900,000 mansion is within your means, then go for it. But for many people, that’s not realistic.

You’ll only get the home that you can afford to pay for it. As for the dream homes, please stick to the rivers and the lakes that you’re used to.

2. Create A Budget

Once you’ve set a goal, it’s time to create a budget that will allow you to save up for your down payment. The way to do that is to reduce expenses.

You’ll have to look at your monthly expenses and see if you can cut things like subscriptions and gym memberships.

As you know, you’ll traditionally need 20% down payment to buy a home, but this is not always the case. Many lenders an take down payments much lower than that.

3. Get A Government Loan

The way to afford the home you want is to get a government lender to give you the money. No offense, Bank of America or Regions, but government loans are usually way more generous.

There are some great lenders that let borrowers put down way less than 20%. Here are a few:

- FHA loans

- VA loans

- USDA loans, (no down payment required)

4. Get A Side Hustle

Another great way to save up for a home is to get a side job. Don’t think that you need to kill yourself to earn some extra income. All you need is something to add to the pot you already have.

5. Save Your Big Money

Chances are you’re going to get big money at least three times in a calendar year. Save it for your down payment.

No matter if it’s your holiday bonus, tax refund or even your stimulus payment, you will have an opportunity to save big money. All you have to do is put it away.

How Much Money Should I Save A Month To Buy A House?

Because you’ll need to save money incrementally, it’s good to put together a plan to set cash aside each month. How much should you save? It depends.

If you want to buy a home that costs $250,000, you’ll need to save $250 a month for four years until you come up with 20% down payment. That’s around $50,000.

Here’s how to find out much rent you can afford in New Orleans.

How Much Money Do I Have To Make To Save For A House?

A lot of people don’t think they can save money for a house because they aren’t making big money. You may be wondering what kind of salary you need to pull to save up for a home.

The truth is that it depends on what the prices are in your local real estate market.

If you the homes in your area cost $200,000, then you’ll need to save $60,000 for a 30% down payment. If you save $20,000 a year, you can accumulate $60,000 in three short years.

Final Word

If you’re serious about saving for a home, there’s nothing that says you have to only save 20% for your down payment. Why not aim for 30%?

The more you save, the cheaper your home will be over the length of the mortgage. If you can save money on the front end, once you get inside your new home, you’ll sleep much better.

Read more: How To Buy Land In 6 Easy Steps

Interested in other ways to save or make money? Check out our Money Section:

More From NolaFi.com:

-

If you’re looking for foreclosures in New Orleans, Louisiana, you can find them if you know where to look.

The good thing about foreclosures is that you typically pay less for them than you would a home on the open market.

What You Need To Know About Foreclosures In New Orleans

Perhaps you’re an investor or just someone looking to score a deal on a home sale. If so foreclosures are a great place to look.

In this article, we’ll go over everything you need to know about foreclosures, including where to find them.

What Is A Foreclosure?

A foreclosure is a process in which the deed holder of a property seeks to take ownership of it, usually due to unpaid debt.

Because the debtor loses possession — and rights — to the home, the lender will look to sell the home under its value.

This makes the home especially attractive to investors. Meanwhile it is an understandably emotional transaction for the previous owner.

Is It Smart To Buy A Foreclosed Home?

Buying a foreclosed home is a great way to get a property for less money than it’s worth. Buying a home in pre-foreclosure — meaning, before it enters the foreclosure phase — may be when the owner is at their most motivated state.

That being said, the wisdom in buying a foreclosure rests entirely with your plans to profit from it. If you don’t have a plan, then buying a foreclosure may be a terrible idea.

Now let’s go over some steps you need to buy a foreclosure. There are three ways you can buy one:

- In Pre-Foreclosure

- At Foreclosure Auction

- From The Bank (REO)

But first, you need to know where the foreclosures are U.S. foreclosure filings are down across most of the U.S., but they’re up double digits in these cities:

- Baton Rouge, Louisiana (43%)

- Atlanta, Georgia (up 25%)

- Salt Lake City, Utah (up 17%)

- Orlando, Florida (up 16%)

- Portland, Oregon (up 16%)

Now, if you live in one of these cities, all you need to do is get a foreclosure filings list to see the properties. Let’s go over the three ways you can buy a foreclosure:

In Pre-Foreclosure

If you learn that a home is in pre-foreclosure, that means that the bank or lender has notified the homeowner that they plan to foreclose on the property.

This creates a motivated seller. If you happen to approach the homeowner about selling the property, you can get it for a good price.

The key to buying a pre-foreclosure home is to get while the owner still has control. Once the property goes into foreclosure, the owner loses all rights and you have to deal with the bank.

What’s different about buying a home in pre-foreclosure is that, you typically have to pay the following:

- Loan balance

- Any liens on the property

- homeowners insurance

After that, you take over possession of the home from the seller. Again, remember to handle the transaction with all due care, dignity and respect.

What’s The Difference Between A Foreclosure And Short Sale?

A lot of people confuse a foreclosure with a short sale. Although they can be similar, they are starkly different.

In a foreclosure, the bank repossesses the property and any sale would have to take place with the buyer and the bank. In the case of a short sale, the owner still holds possession of the property.

Here’s what to know about a short sale.

Where To Find Pre-Foreclosure Homes

You can find real estate listings that will show you plenty of pre-foreclosure homes.

- Homefinder.com

- Realtor.com

- RealityTrac

- Preforeclosure.com

- HudsonandMarshall.com

- Firstsourcere.com

- Trulia.com

- Zillow

You may also try to get the a distressed property at foreclosure. Let’s talk about it:

At Foreclosure Auction

A foreclosure auction often takes place on the courthouse steps. The Sheriff conducts the auction and ensures that order takes place.

A bailiff or another official may preside over proceedings, reading out properties from a foreclosure list. All you have to do is be present and bid on the properties to participate.

Be wary of some foreclosures if you haven’t done your research or driven by the properties. Many of them are uninhabitable and may required extensive repairs.

If you end up buying a money pit, you’d better have a plan. That’s because once you buy a foreclosure, you’re liable for all expenses related to the home.

Bank-Owned Property

You may choose to buy a property straight from the lender. This is typically considered a bank-owned property.

The bank has a right to hold onto a property as long as possible, so be aware that sales often take months and maybe even years.

Where To Find REO Properties

- Familiarize yourself with the Multiple Listing Service (MLS), which has a list of REO properties.

- Contact Realtors: Real estate agents know where all the REOs are in any given area.

- Go online and Google search “REOs near me” to find listings in your area.

With any real estate transaction, make sure you get in touch with a real estate attorney so that you’re protected legally.

Final Thoughts

Foreclosed homes are those that you typically buy at auction from a bank or creditor. Because banks don’t want to stockpile these properties, they are usually sold below market value.

When you buy a foreclosure, you have to purchase it with cash, so you should make sure that you have the funds.

More Articles: