If you’re trying to buy a house, one of the most important determining factors is your creditworthiness.

This article will show you what credit score you need to have to buy a home.

What Is Considered A Good Credit Score?

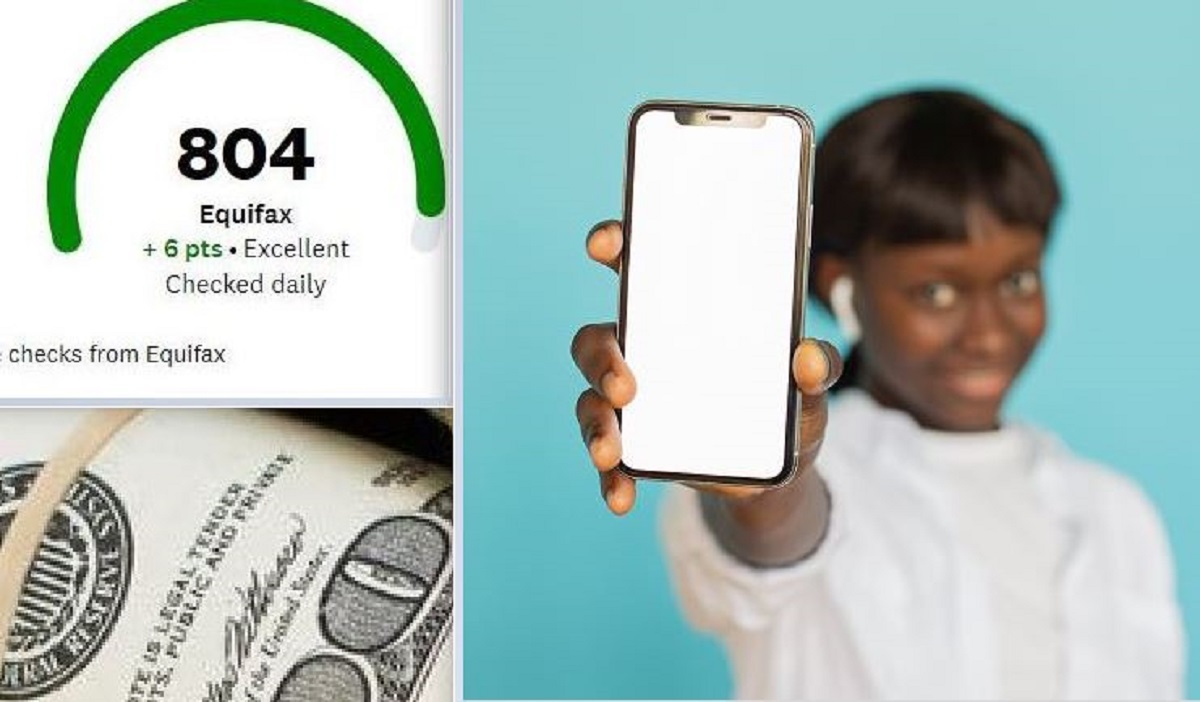

A good credit score ranges between 600-730. The three-digit FICO credit score can go all the way up to 850, which is elite credit.

Most Americans fall within the lower 700s when it comes to their credit scores, but there are millions of people who are way below that. If you’re part of that group, first, you need to understand how you may be hurting your credit score. For instance, are you carrying a balance from one month to the next? That’s the #1 credit-hindering mistake many consumers make.

Pay your credit card bill in full to raise your credit score. That’s the key. Once you’re out of debt, you can begin saving for a house.

What Credit Score Do I Need To Buy A House?

To buy a house, your credit score needs to be at least 600, according to mortgage lenders. Anything below that and you’re in the sub-par category, which greatly restricts your purchasing power.

Buying a home is one of the largest purchases you’ll ever make. Typically, you’ll have to borrow enough money for a 15- year or 30-year loan. What usually determines which loan you choose is the amount of income you bring in and your credit score.

Final Word

Your credit score is an integral piece of your financial well-being. If you want to purchase a home. To stay on top of your credit score, you can get a free credit report delivered to you online.

You can buy a house with without a credit score as well: By paying all cash, which is something investors do all the time.

Are you looking into becoming a landlord? Here’s how to buy rental property in Louisiana.

More From NolaFi.com: